We recently published a video about how to make your first hire in a mortgage brokerage, but thought we’d follow it up with some more in-depth detail. Hiring your first recruit is a huge step for a one-man band mortgage broker. It’s a huge investment, and one you want to make sure you’re ready for.

This simple checklist will outline all the things you need to think about before you take the step towards becoming an employer.

✓ Decide on the type of recruit you need

A big question for many mortgage brokerages when growing the business is: who should I hire first – a mortgage broker or a loan processor? This consideration can trip a lot of people up, and is an important decision to make. Weigh up your own personal strengths and gaps as a mortgage broker, and decide what role would best suit the needs of the business as you take it to the next level.

✓ Work out your costs

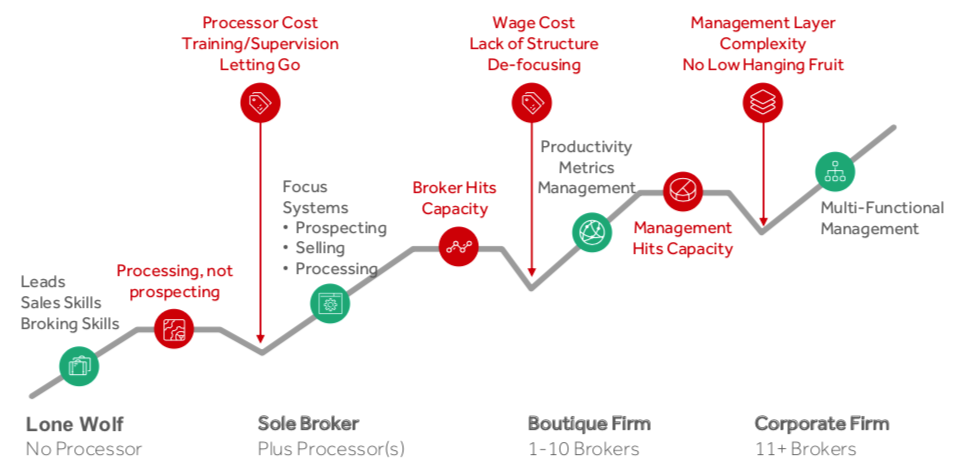

Poor cashflow management is one of the key reasons that businesses struggle after the first hire. There’s always going to be a ‘dip’ in revenue after you hire someone new, as Craig Vaughan explains in his article Why Most Mortgage Broking Firms Don’t Scale (And What To Do About It).

We generally recommend that business owners ensure they have enough money in the bank to pay an employee for 6–9 months before making the hire. If your settlements suddenly drop off over the next few months, you don’t want to have to let go of the wonderful person you’ve just hired.

Your next consideration is how much you’re willing to pay an employee. This will largely come down to the type of role you’re hiring for and the level of experience they have. While many businesses hire juniors to begin with to save costs, consider how much support and time a more junior person will require from you as they’re getting up to speed.

Beyond the candidate’s salary, there are also other expenses to take into account when hiring. There are costs related to working with a legal professional to secure employment documentation. You may even think about outsourcing your payroll management, which is an added cost but may save you time and hassle in the end.

✓ Develop a recruitment procedure

It’s important to have a framework in place when going into the recruitment process, to avoid wasting time and money on unsuitable candidates. Work out how you’re going to screen and qualify candidates, and write this up into a process you can easily follow.

Perhaps you’ll start with a phone call to screen people, with certain questions you’ll ask to identify if they fit with your culture and have the technical skills required for the role. After this, you may have one or two rounds of interviews, depending on what you think you’ll need to pin down your ideal recruit.

Think beyond how you’ll attract people with salary. Can you offer them the career development and progression they need? Having a suitable recruitment procedure is about investing time into ensuring you hire the right people so you can set them up for success while also setting your business up for success.

✓ Develop an employment framework

Spend time working out the type of role you need to hire for and drafting a suitable position description. This will include details on the purpose of the position, the target markets, expected results, KPIs and employee behaviours. Fleshing out your position description effectively will help to set expectations from the beginning so it’s clear for your new employee what their role involves and how performance will be measured.

Before your new recruit joins the team, you should have a clear management framework and career development plan for them. Your management framework will set you up to manage your employees, outlining specifics such as when you have catch-ups and check-ins, how their performance will be tracked and what their development looks like. As an employer, it’s your responsibility to ensure your team is happy and supported, and doing this will ensure strong retention in your business.

✓ Plan your onboarding and induction experience

Onboarding should be comprehensively planned out before you make your first hire. When your new recruit goes home after their first day and their friends and family ask them how it went, you want them to respond emphatically that it’s a great place to work! Consider how you can create this experience for them.

Make a plan for the recruit’s first four to six weeks, outlining how you’ll onboard and train them. Draft up a career development plan that takes into account all forms of training, including on-the-job training, professional development events, conferences and webinars, and training on your platforms and tools. The onboarding process should get your new recruit off to a good start, setting them up to succeed.

✓ Get guidance and support

Hiring your very first recruit is a huge step for small businesses to make. We understand how challenging and daunting it can be. Consider how you can reach out to others for advice and support in making these decisions.

In some cases, outsourcing parts of the recruitment process can save you time and money when done by a professional. Here are a few of our go-to providers when it comes to recruitment for mortgage brokerages.

Employment lawyer

Corvus Group is an experienced legal firm with strong knowledge in the area of employment law. Their lawyers are experts at drafting employment documentation and advising on employee structures. We use them ourselves when hiring new recruits and are very happy with their level of detail and attention.

Accountant

Factor1 is an exceptional accounting firm that can help business owners better manage their finances and assist with bookkeeping and payroll.

Business Coach/Training

Professional development is vital for small business owners. Although it can seem like an unnecessary expense for some, investing in yourself will help you learn, grow and mature in your business more rapidly. There are specific broker events and workshops you can take part in, as well as business coaches you can turn to for advice and support. We can highly recommend industry leader Jason Back, who runs Broker Essentials training and coaching.

Recruiter

Obviously we’re going to take the opportunity to give ourselves a little plug too!

As a specialist mortgage broking recruitment firm, Platinum People Group has worked with dozens of small business owners, helping them set up an effective recruitment model to grow and scale their business. We can manage the end-to-end recruitment process for you, or provide guidance in areas you need support in specifically. We love helping mortgage brokers navigate hiring, and we’ve created plenty of Business Advice resources to help you along your journey of running a business.

If you’d like some one-on-one advice about growing your mortgage brokerage, get in touch with our team.